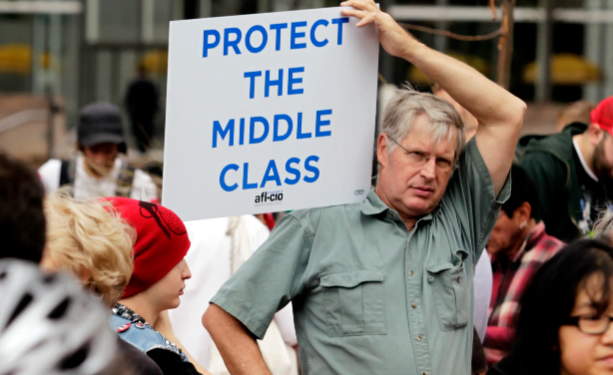

For a long time, the U.S. economy has been hailed as the “number one in the world.” Its GDP leads globally by a wide margin, corporate profits continue to reach record highs, and the stock market frequently breaks new ground. The wealth of the ultra-rich has surged at an astonishing pace. However, beneath this apparent prosperity lies the harsh reality facing America’s middle class—a reality that has long been overshadowed and overlooked.

I. Stagnant Income Growth: The Squeezed and Stripped Middle Class

First, let’s look at income. A major cause of the structural dilemma facing middle-class households is stagnant income growth. Over the past half-century, U.S. middle-class incomes have nearly stagnated. According to the Economic Policy Institute, between 1990 and 2023, middle-class family incomes rose by only 19% (while high-income groups saw a 64% increase during the same period). Brookings Institution data shows that only 50% of Americans born in the 1980s earn more than their parents—a sharp decline compared to 92% for those born in the 1940s. The middle class’s share of the population has shrunk from 70% in 1970 to 50% in 2023, a clear downward trend.

This stagnation is primarily due to globalization hollowing out U.S. industries, reducing wealth creation in material production, while financial assets like stocks and bonds skyrocketed—concentrating wealth with capital owners. Moreover, the middle class bears heavy tax burdens: combined federal, state, and consumption taxes reach approximately 30%. That excludes property tax and Medicare tax—adding property tax (1–3%), Medicare tax (2.9%), and other local levies (e.g., sales tax) brings the total effective tax rate to 35–40%. Thus, even if nominal middle-class incomes appear reasonable, after taxes their disposable income is quite limited.

In recent years, thanks to policies favoring both the top and the bottom, the middle class has become the “stripped and squeezed layer”: unable to rely on asset appreciation like the rich, yet unable to benefit from transfer payments like low-income groups—instead bearing the brunt of societal costs.

By the way, Professor Qin Hui’s theory of “negative welfare” is widespread. But in essence, welfare is a form of mandatory transfer payment—if some receive “positive welfare,” others must bear “negative welfare.” He argues that Chinese citizens receive negative welfare, while Westerners receive positive welfare—but this is clearly wrong. Regardless of China’s situation, by his own logic the U.S. middle class is also typical “negative welfare”: paying welfare’s cost without receiving its benefits.

II.The Black Hole of Fixed Expenses: The More You Earn, the Less You Keep

The American middle class is not only struggling to “increase income,” but also finds the path to “cutting expenses” completely blocked. As we’ve previously examined, one striking feature of middle-class spending is its highly rigid structure—like a black hole devouring cash—making it extremely difficult to save money.

Housing, Education, and Healthcare: The Three Mountains Crippling the American Middle ClassHousing is the foundation of every family, yet it also constitutes the largest portion of household expenses. In 2024, the median home price in the U.S. surpassed $430,000. For the average household, mortgage payments consume 32% of income. In our case study of a family of four in Columbus, Ohio, housing costs accounted for a staggering 41% of household income—well beyond the 30% threshold considered financially burdensome. On top of the mortgage, families must also cover property taxes, homeowner’s insurance, HOA fees, and maintenance costs—all significant and unavoidable. Renters face similar pressure, with rents rising 24% between 2019 and 2023, far outpacing wage growth.

In recent years, college tuition has skyrocketed. Private university tuition has surged 181% over the past two decades, and public university tuition has jumped 141%—three times faster than middle-class income growth. Graduates burdened with $50,000 in student loans often earn a starting salary of only $55,000, taking a decade or more to repay their debt.

While public K-12 education is technically free, its quality varies dramatically. Middle-class families who want better foundational education for their children are often forced to buy homes in top-tier school districts—driving up their housing costs, taxes, and other related fees. The alternative is private schooling, which comes with hefty tuition fees. On top of this are expenses for after-school care, summer camps, and extracurricular classes, which can quickly add up.

Healthcare costs are another major burden. In 2024, the average annual healthcare expense for an American family reached $25,572. Even with insurance, patients must pay significant out-of-pocket costs. Deductibles (typically $5,000–$10,000) and co-pays (20%–40%) can bring a family’s true annual healthcare expenditure above $30,000. Insurance claim denials are also not uncommon. While insurance policies have annual out-of-pocket maximums, for families dealing with chronic illness, long-term costs can easily exceed affordability.

Beyond the three major expenses—housing, education, and healthcare—transportation is a necessity due to America’s low-density urban sprawl and limited public transit. This means car ownership is non-negotiable. Loan payments, insurance, fuel, maintenance, and parking together cost families around $12,000 per year. Utility bills—including electricity, gas, water, phone, and internet—are also high and continuously increasing.

Historically, food and energy prices in the U.S. have been relatively low, but recent inflation has changed that. In 2022, food prices surged by 11.4%, while energy costs soared by 34%, further eroding the purchasing power of the middle class.

In short, American middle-class families face limited lifestyle flexibility. Maintaining even a modest standard of living now requires high and rising costs. Unlike in China—where families may opt for a frugal lifestyle when income is tight—middle-class Americans are caught in a rigid, high-cost trap that leaves little room to maneuver.

III.A Fragile Balance: One Crisis Away from Collapse

The “high income – high spending – low savings” model leaves America’s middle class walking a financial tightrope. With limited opportunities to increase income and few avenues to cut expenses, many middle-class families struggle to save or build emergency funds, making them vulnerable to sudden shocks. According to data, 40% of U.S. middle-class households cannot cover a $400 emergency expense; the median credit card debt stands at $6,500 with an annual interest rate of 22%; and for those aged 55–64, the median retirement savings is only $134,000.

Such fragile financial conditions mean that any crisis—be it medical, job loss, or natural disaster—can trigger a rapid downward spiral. A single missed bill payment can set off a chain reaction that erodes a family’s net worth. Once the debt cycle begins, it can easily push a middle-class household into poverty.

For example, a medical debt sent to collections can lower credit scores, which then raises interest rates on car loans and mortgages. Insurance companies may respond by increasing auto or homeowners’ premiums. These compounding costs worsen an already strained financial situation. Missing mortgage, property tax, or HOA payments could result in liens or foreclosure. If medical or consumer bills are overdue for more than 30 days, creditors may seek court judgments to seize bank accounts, garnish wages, or even repossess vehicles. Under federal tax laws, households with student loan or medical debt delinquencies lose eligibility for education tax credits like the AOTC, adding to their burden.

A history of bankruptcy or poor credit can lead to loan rejections, difficulty renting a home, and restricted job opportunities—amplifying the fall from the middle class. Falling into poverty is easy, but staying in the middle class requires high costs: housing maintenance, education, continuous career development, and social expenses. To afford this lifestyle, many middle-class individuals sacrifice rest and take on side jobs just to stay afloat.